A preliminary position is the sale of a protection for the presumption one the really worth usually decline. Time buyers may take short positions inside the carries, ETFs, or any other assets which they believe is actually overvalued otherwise features weakened development prospects. An extended position ‘s the acquisition of a protection on the presumption that it’ll rise in worth.

Start by a solid Foundation

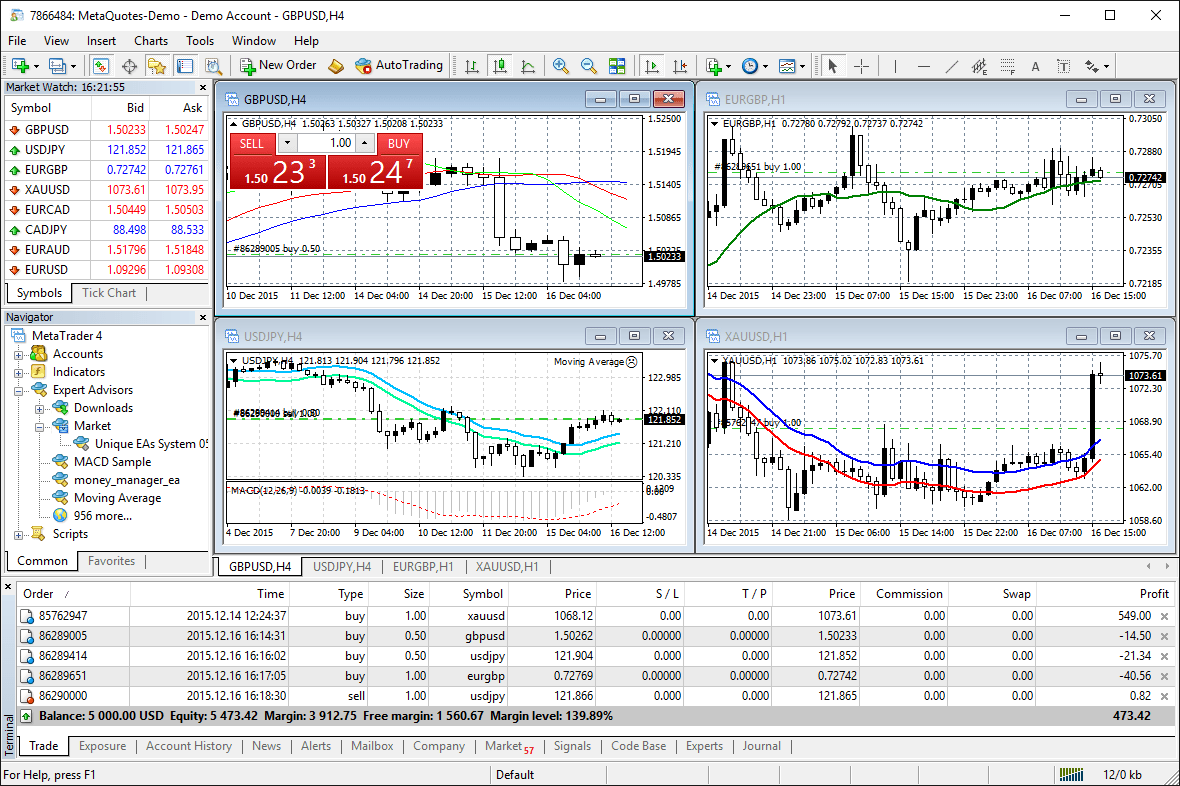

Because the people presently has relatively easy access to on the web exchange, exactly why are here only a few succeeding while the day traders? Anyway, what investor hasn’t wanted to be day trader—doing work easily at your home, being their employer, seeing profits roll inside? Inside our advice, an educated swinging average for go out change ‘s the SMA(Simple Moving Mediocre) because of it’s precision and you will precision. Go out change is the operate of purchasing and you will attempting to sell securities(carries, crypto, futures deals, alternatives, etcetera.) in the exact same day. No matter what instrument you are change, when you’re beginning and you will closing the career in the exact same day, it is experienced go out change.

With sufficient sense, skill-strengthening, and uniform results assessment, you’re in a position to defeat chances and you may improve your odds of trading profitably. In case your strategy is within your chance restrict, next evaluation starts. By hand read historic maps to locate entry items that suits your. Notice if the prevent-losings order or rate address could have been struck.

But not, they should funds far more https://connectimmediat.com/ from their winners than simply they get rid of on their losers. Ensure the monetary chance on each trade is bound to help you a specific percentage of your account which admission and you can log off actions is demonstrably discussed. The best company detail compatible actions, establish risk management process and supply information to the type of areas, for example forex, stocks, cryptos otherwise futures.

Work with a couple of areas

While enough time-identity using offers time for an investment to help you dish aside, day trading doesn’t. Should your field moves in different ways than you questioned, you can remove nice currency—particularly if leverage is used. It’s critically crucial that you understand the risks working in time change, create all chance you are confronted with, and get happy to deal with losings. To own stocks in america, the fresh Trend Go out Buyer (PDT) code means at the least $25,100000 in your membership if one makes cuatro or more go out positions within 5 business days.

Controlled brokers provide sort of precision and you can assurance as you know that the newest regulating government are there to help cover financial consumers such as your. This might include the kind of broker, whether it’s controlled, it’s advances, a variety of some thing, it’s up to you. If your broker’s investigation is not state of the art, and when it wear’t feel the structure positioned to transmit the above mentioned assistance, next specific security bells would be to band. You change fx (FX) by speculating on which direction an excellent currency couple tend to disperse.

Next for many who place a real income for the field, use only financing you’re ready to eliminate since most time investors perform lose. Fool around with proper chance administration all the time and always self reflect on your own exchange to progress and get a far greater trader and end big loss. Time trading are challenging for its quick-paced nature and the complexity of the financial areas. It needs investors to make small conclusion considering genuine-date advice, which is challenging, especially in unstable market requirements. Investors should be expert at the tech investigation, interpreting charts and you may habits, and you can focusing on how financial events dictate industry actions.

The easiest way to steer clear of the trend day individual laws is via to prevent margin completely by using a funds account. But the majority of on the internet brokers, including Robinhood, give you a margin membership automatically, meaning you’ll have to look into the membership configurations and manually switch-over in order to a profit account. Dollars membership may also have extended settlement situations where you sell a security (that is, sale continues aren’t quickly offered and could bring a few days so you can hit your bank account). Paper trading makes you behavior advanced change actions, for example time exchange, with fake cash before you can exposure real cash. Here you will find the brokerages that provide totally free papers exchange account.

- If you’lso are having a hard time determining whether or not you will find a cycle for the inventory chart or not, chances are that that isn’t a great tradable inventory trend.

- All of these courses are fantastic depictions from how winning investors turned winning.

- You can even discover country-particular possibilities, such as go out exchange tips and methods for Asia PDFs.

Novices can choose centered on the go out availableness, exposure threshold, and you can desires. Starting with swing trade is usually recommended for their balance out of date union and you may funds prospective. A good thing to watch out for is when it’re providing a holy grail. Which is, the only single exchange strategy that will offer relief from all losings, and you may allow you to trade gladly ever before thereafter. Another reason is the fact a couple independent trade procedures aren’t attending falter meanwhile. Even though extremely instructors obtained’t should tell you that all the exchange procedures has a restricted lifetime-duration, that’s the fresh harsh details i’ll suffer from since the investors.

Investors make use of these accounts since the prospective assistance and you may resistance section. They look to possess speed responses close pivot items to generate change decisions. Buyers using this approach choose and you will trade-in the fresh direction out of the present industry pattern. It enter enough time (buy) ranking inside the uptrends and you can short (sell) positions inside the downtrends, planning to journey the price impetus for area of the trend’s path. This tactic relates to to make numerous small trades all day long, planning to make the most of tiny speed movement. Scalpers work with short entries and you can exits to fully capture small development, counting on higher trade quantities and you will rigid advances.

These platforms provide trial profile, enabling you to habit instead of risking a real income. I recommend tinkering with a number of to get the one that best suits their trade design and needs. Deciding on the appropriate products is crucial to achieve your goals inside the go out trading. I’ll guide you from the important products and you will platforms that may help you create told conclusion and play positions efficiently. Electronic platforms render actual-time investigation and you will instantaneous buy execution.